Invest in the Future... of Education, Work, and Travel

Revenue generating

Revenue generating Recession-proof

Recession-proof Fully Monetizable product

Fully Monetizable product Humans. Destinations. Cultures.

Humans. Destinations. Cultures. 2.8B individuals - trying to solve 1 problem, “How do I connect across language and culture”

2.8B individuals - trying to solve 1 problem, “How do I connect across language and culture” Apto uses AI connects the dots between humans and destinations of choice so they can thrive

Apto uses AI connects the dots between humans and destinations of choice so they can thrive

Apto Global open for investors. We're offering you the opportunity to own equity in a multi-industry disruptor.

Revenue generating

Revenue generating Recession-proof

Recession-proof Fully Monetizable product

Fully Monetizable product Humans. Destinations. Cultures.

Humans. Destinations. Cultures. 2.8B individuals - trying to solve 1 problem, “How do I connect across language and culture”

2.8B individuals - trying to solve 1 problem, “How do I connect across language and culture” Apto uses AI connects the dots between humans and destinations of choice so they can thrive

Apto uses AI connects the dots between humans and destinations of choice so they can thrive

Apto Global open for investors. We're offering you the opportunity to own equity in a multi-industry disruptor.

World-Class Funding & Support

We have $475 thousand in non-diluted funding from NASA & the Airforce and 3 approved patents.

World-Class Funding & Support

We have $475 thousand in non-diluted funding from NASA & the Airforce and 3 approved patents.

World-Class Funding & Support

We have $475 thousand in non-diluted funding from NASA & the Airforce and 3 approved patents.

How it Works

Step 1

Schedule and Learn About

Our 5-Year Exit Plan

Step 2

Chat With Our Team

and Founder

Step 3

Invest And Own Equity

in a Disruptive App

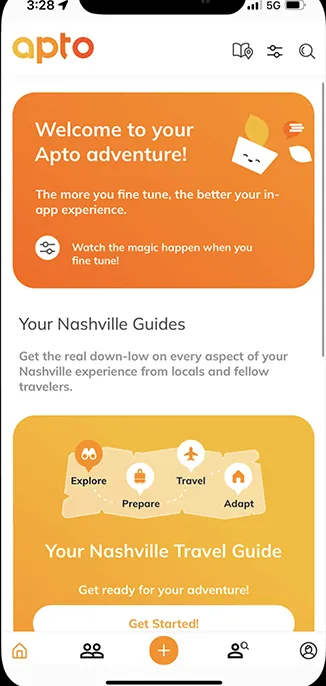

What is Apto Global?

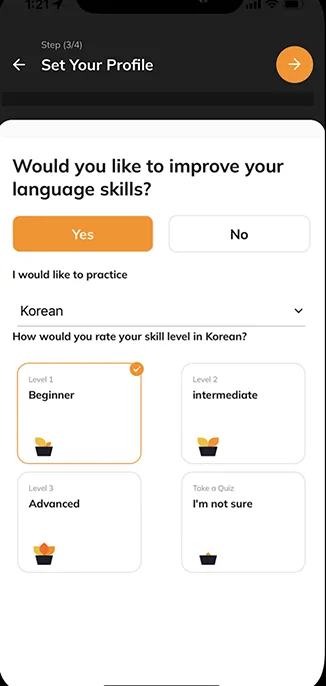

More than 2.8 Billion Humans need the connections, skills, and services to “adapt to life anywhere.” Currently, they would have to use as many as 7-12 online apps and/or offline resources to help them do that one simple thing.

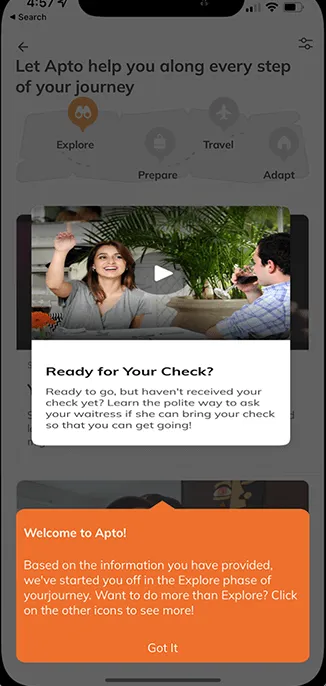

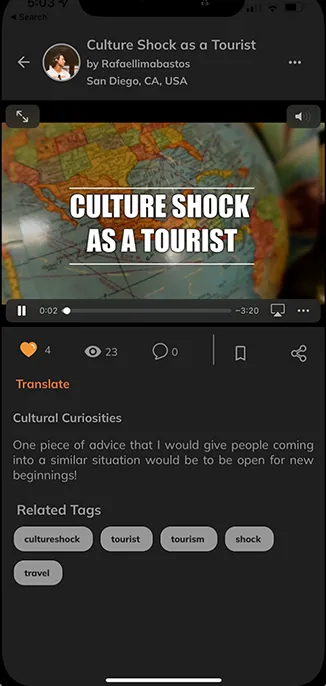

Apto is the only app-based culture, language, and travel community dedicated to meaningful cross-cultural exchange that helps humans adapt to life anywhere whether:

Exploring Cultures

Exploring Cultures Interacting Virtually

Interacting Virtually Going on Vacations

Going on Vacations Studying

Studying Working

Working Relocating

Relocating

The Industries We

Plan to Disrupt

From our advisory board to our investors, we all have connections to some aspects of the industries we are working hard to move from fragmentation to innovative unification. This includes:

The Language sector (Rosetta Stone, DuoLingo, GlobalLT, iTutor, and more)

The Language sector (Rosetta Stone, DuoLingo, GlobalLT, iTutor, and more) Culture, SaaS, Social, and Travel Multinational Companies

Culture, SaaS, Social, and Travel Multinational Companies Global Brand leaders ripe for distributive partnerships such as Samsung

Global Brand leaders ripe for distributive partnerships such as Samsung

While top-down calculations may yield a GAM as high as $653B, we used a bottom-up approach, to identify a conservative $9.8B Total Addressable Market.

What Makes Apto Global Unique

We are partnering with cutting edge companies like ValidSoft who boast the most accurate voice biometric technology to ensure the physical, psychological, and fiscal safety of our users, as well as to provide greater convenience as the technology advances.

Imagine being a member of a social community where you could not be defrauded, catfished, deep-faked, or targeted by sexual predators, with all community members being held accountable for their words and deeds in-app.

Why Now?

Online social media is in a swirl and industry leaders believe that apps that promote strong creator monetization, digital humanity, and have legitimate utility will win. Apto checks all three boxes.

Organizations are looking for community features that make social connections easy with the added benefits of safety and privacy. Apto is the only social solution providing that. This gives us access to an exponential amount of users.

The global pandemic transformed so many different sectors and Apto is ready to take advantage of these opportunities from the convergence of global mobility,

wellness and DEI, to the new emphasis on remote working and education.

History has shown us that any solution with an EdTech component typically thrives in an economic downturn. By bringing multiple solutions into one single platform and reinvesting 18% into our community economy, we will thrive in the current economy.

We have the first mover advantage cardinal rule. We are here first, now we need capital to ensure we stay that way and capture as much of the total addressable market as possible

Our Vision

Our Vision

In one year Apto will have:

- A complete product suite with multiple monetization streams

- Close to one million daily active users, nearing if not surpassing break even.

- Launched as a Made for Samsung partner

- Attained global brand awareness.

In five years:

We will either be acquired for a strong multiple, or be cash-flowing so well that members/shareholders are benefiting from ongoing passive income and continuing to grow the value of the company.

In ten years:

We will have exited to a fit that will provide both an ideal multiple and a long term vision that continues to honor and uphold the values and brand attributes its founder and founding team worked so hard to attain.

Meet the Founder

Traci Snowden, CEO and Founder of Apto Global

Apto’s CEO and Founder grew up straddling two languages and two cultures at home and experienced even greater cultural diversity at school and while traveling with her mother and father on the Native American art circuit - in fact, by age 12 she had been in all but 10 of the fifty nifty United States.

Driven by worth ethic, resilience and passion, she did not grow up with a silver spoon but began earning income at age 13 doing taxes for the family business and then working summers for other local businesses. She earned scholarships to university and study abroad, earning degrees in international business, foreign language education and acquisition.

In her twenties, she had the privilege of working with a start up from early growth to exit and was mentored by executives, allowing her to experience the nuts and bolts of a start-up and rotate through teams, ultimately using that acumen to create her own vertical first in inside sales and then moving to outside sales.

In 2015, after the company exited, she began the predecessor company to Apto, a service-based business model that was profitable within 6 months and provided paid user research and early clients for the first iteration of Apto.

In short, her education, work and entrepreneurial experience across language, culture, technology, sales, operations and global travel/mobility have accumulated to create the perfect organic path to her present role.

She has also led this team through a major pivot, a global pandemic and a restructuring with ample skin in the game. Resilient leadership is an understatement.

Meet the Team

Mark Riggleman

Director of Product & Content

Mustafa Muwwakkil

Principal Designer

Keith Starling

Director of Technology

Milena Rimassa

Director of Marketing

Lucy Miller

Business Operations & Investor Relations

Morgan Michell

Content Manager

Rebecca Smith

Marketing Manager

Carley Allison

Executive Administrator

Each team member and advisor brings their own personal networks to bear on Apto’s behalf, supporting access to partners, clients, talent and more…

Our Investment Details

Apto is raising $5M for early growth in exchange for roughly 16.8% equity.

Our minimum check size would be $250k, but to expedite the first $1M tranche we are accepting check sizes of $50k.

Companies in our sector are currently raising at valuations of between $15M and $40M on average and an exit multiple of 13.5X is industry average.

FAQ

1 What makes Apto Global a better option than its competitors?

I started this company after noticing that social media is ripe for disruption. From our advisory board to our investors, we all have connections to some aspects of the industries we are working hard to move from fragmentation to innovative unification This gives us the advantage of being a first-mover in our niche.

2 What returns can I expect from investing with Apto Global?

We expect to hold investors’ capital for around 5 years, and we're targeting an exit that could potentially returns 10X+ for early investors.

3 Why is now the time to invest with Apto Global?

We have the first mover advantage cardinal rule. We are here first, now we need capital to ensure we stay that way and capture as much of the total addressable market as possible. We are perfectly positioned to capitalize.

4 How will Apto Global use the capital raised?

Our plan is to launch complete product suite with multiple monetization streams, which will put us at close to one million daily active users, nearing if not surpassing break even within one year.

What is a Start-Up?

You may think of a pretty basic answer that most people would probably give:

A start-up is a newly started company with a huge vision and ambition to scale and grow.

But look at it from a different angle:

What does a startup mean to you?

What does a startup represent?

A startup may represent a lot of things.

It may represent dreams, ambitions, goals.

The list goes on and on.

To me, a startup represents hope.

It represents passion.

And there is no passion found in living small.

Passion is your strongest motivator. It is what pushes you through broken dreams, what pushes you through monumental failures, what pushes you when you’re beaten, bloody, broken, and on the ground.

Nobody can explain your passion for something, just as no one can explain what light is to the blind.

At the heart of every startup, there’s a founder. And at the heart of that founder, is drive and ambition. And the thing that founded this drive and ambition, the thing that made the founder become a founder and not just another follower, is passion.

Think of all the failed startups out there, think of all the founders who once had such great dreams and visions for their new business….

…and think of all those shattered dreams and ruined visions.

Think of a small, cozy, family café, an indie business founded by a loving couple who poured their heart and soul into building their establishment from the ground up… for it just to turn into a ramshackle, broken down, boarded up, and abandoned empty space.

Sadly, that’s what most startups end up becoming.

9/10, i.e. 90%, of startups fail.

7.5/10 venture-backed startups close down.

What do you think the top 3 reasons are?

They’re a lack of product-market fit…

…a lack of good marketing….

…and a lack of financial support.

And out of all these failed startups, out of all these broken dreams, came Elevator Rolling Fund and my passion in helping these startup businesses.

My name is Dan Fleyshman, and I’ve seen these failed startups.

I’ve seen founders and owners with defeat and sorrow in their eyes because they were forced to close down the product of their passions and dreams.

And that’s what I set out to fix with Elevator.

Elevator Rolling Funds gives startups, with the most potential, a fighting chance.

We not only offer them access to a huge pool of venture capital from angel investors, but we drastically help with their brand and social media presence, include them in a gigantic network of highly successful business owners and entrepreneurs, a network that helps them with customers, partners, manufacturers, vendors, influencers, and even other investors.

We stay with them from strategy to execution.

I personally take them through the vetting process, because I not only want to give you, the investor, the chance to invest in the companies with the most potential, but I like being personally involved. I like sharing the passion and dream I have to scale up businesses. I only choose businesses whose founders are ambitious, relentless, driven. And most importantly, founders who believe in themselves, their company, and what they’re trying to achieve.

And I know that finding these kinds of companies is a struggle for investors. A struggle that you no longer have to go through because Elevator takes care of all that for you.

You just have to sit down and enjoy the ride, watch a healthy stream of returns to your pocket, knowing that you’re helping people live their dreams out there.

That’s something you can be a part of.

A part of making other people’s dreams come true.

A part of making this world a happier, better place, even if just by a tiny smidge.

And without investors like you, none of that would be possible.